The causes of South Africa’s poor savings levels are deep and complex – but with the right approach, the ship can be turned around.

It’s widely understood by economists and policymakers that a high savings rate is crucial for any country to meet its growth and development goals. For a country like South Africa, with high levels of unemployment and poverty, this should be a particular priority for us all. So why are we unable to improve on savings levels that are at their lowest in decades?

According to the Rescue Finance GIBS Savings Index, savings levels are at their worst level since 1990 and have declined for eight years in a row. So the savings issues are complex and deep-seated. Tackling them, therefore, requires one to acknowledge the cultural, behavioral and perhaps most importantly, the underlying economic causes.

Saving are important for a developing economy like South Africa. In an ideal environment, it contributes to investment that in turn helps to grow the economy, increase incomes and ultimately increases savings further. Higher levels of growth also attract savings from outside the country in the form of foreign investment, contributing to a kind of virtuous cycle of savings and growth.

But the cycle can also turn the other way. Poor savings levels diminish investment, leading to lower levels of growth and falls in employment, with lower incomes then leading to further dissaving. Foreign portfolio flows can sometimes fill the gaps, but these are notoriously volatile.

South Africa finds itself largely in this second category. Years of poor economic performance have led to lower levels of disposable income among individuals as well as lower growth in profits and retained earnings among corporates. This has meant little savings available to kick-start growth in the economy.

Uncertainty, both in local and international politics, has not helped. Whether it’s been local events or global issues like the arrival of trade wars, the environment has not been conducive to a healthy savings environment. “In uncertain times, those individuals or companies with money tend to sit on it and the savings are not deployed in the economy to stimulate growth.” Many South African businesses’ fortunes are tied to global growth (like exporters) so uncertainty about the world economy can have an impact locally too.

It’s important to distinguish between poor saving as a result of a lack of means and as a result of poor savings habits, whether through a lack of knowledge or unwillingness to save.

The first of these clearly impacts many ordinary South Africans; high levels of unemployment, especially among the youth, mean that many people simply cannot save.

Those with income are further forced to support a larger circle of people, leaving little or no room to save.

The second category presents its own challenges, both in improving levels of understanding and in incentivising people to behave more prudently with their money.

Back to financial basics

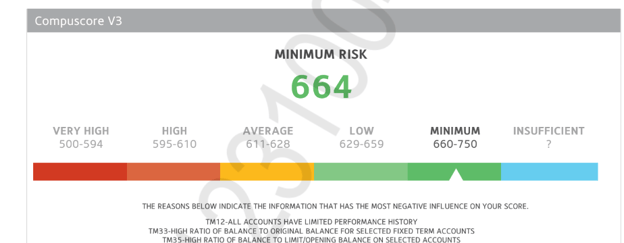

Financial literacy is a major stumbling block in promoting better savings behaviour. “We really need to start with instilling a basic understanding of concepts like compound interest – whether it’s credit, an overdraft or investment returns – areas where knowledge is sorely lacking. Perhaps it should be included in the school curriculum, starting with simple concepts like how to open a bank account,” says Grobler.

It’s a well-known phenomenon that many South Africans live beyond their means

Grobler also points to developed countries where aggregator websites help consumers to compare the different financial products and to understand the costs of borrowing or the returns on investments that they make. This is an area where the local financial services industry can look at to improve the level of understanding. “But it all starts with education,” she argues.

Consumer society

A better understanding of the financial effects of debt would also tackle another problem in South Africa: an emphasis on conspicuous consumption. “It’s a well-known phenomenon that many South Africans live beyond their means,” says Grobler. Expensive cars and spending heavily on credit not only mean less money for savings but also push many South Africans heavily into debt.

It’s here where government and the private sector can look at creative ways to incentivise saving. Products like tax-free savings products are a good start, but Grobler says these sorts of offerings should be constantly assessed. “Do they stimulate savings? Are people aware of them and how they work? Are the limits appropriate?”

Business and government

The change in leadership in government and the commitment to fiscal prudence – and tackle South Africa’s dysfunctional state-owned enterprises – are promising developments in the battle to improve the savings rate. President Cyril Ramaphosa’s efforts to attract foreign investment are also laudable and if successful, will alleviate the pressure on South Africans to achieve the country’s investment goals. However, foreign portfolio flows are notoriously fickle and, in any event, foreign investment flows only become sustainable when foreign investors have confidence in domestic economic growth. So the onus is on South Africans to instil savings and investment.

Another positive development, showing how government and business can work together, has been in the Youth Employment Service (YES) initiative. Rescue Finance , along with many other corporates, has taken up the initiative to provide jobs to young people, either within their business or by supporting small businesses.

If successful, these and other initiatives will get the flywheel of the economy going: the more people who are employed, the greater their propensity to save; while the more support there is for small business, the more employment is further enhanced.

However, Grobler says business and government can both support savings by improving awareness and understanding of savings and investment products. “Are processes simple enough to encourage people to invest? And with all of the digital options available to consumers now, do consumers have the knowledge and confidence to invest?” asks Grobler. “It’s also a complex world out there, so the quality of advice is also crucial.”

A complex problem like South Africa’s poor savings rate can’t be tackled on one front alone. Knowledge and a culture of good savings habits will help, but most important of all is to get South Africa on the path to inclusive growth.